SFDR DISCLOSURES

The Regulation (EU) no. 2019/2088 of the European Parliament and of the Council of November 27, 2019 on sustainability-related disclosures in the financial services sector (SFDR) requires financial market participants such as Biotope General Partner (the GP) to provide information to investors with regards to the integration of sustainability risks, the consideration of adverse sustainability impacts, the remuneration in relation to sustainability risks and the promotion of environmental or social characteristics, and sustainable investment.

We believe that in order to make good investments environmental and/or social factors should not be overlooked, and we intend to promote certain environmental and/or social characteristics for the funds managed by the GP, i.e., Biotope Ventures BV (Biotope Ventures) and Biotope Ventures II (Biotope Ventures II) (Biotope Ventures and Biotope Ventures II are hereinafter jointly referred to as the Funds).

To avoid any misunderstanding, we clarify that both Funds do not have or pursue sustainable investments in accordance with article 9 of the SFDR, as its purpose.

You will find under Part I the GP AIFM level disclosures, under Part II the article 8 SFRD disclosures for the financial product Biotope Ventures and under Part III the article 8 SFRD disclosures for the financial product Biotope Ventures II.

1 / GP – AIFM LEVEL DISCLOSURES

The information below regarding the policies of the GP on sustainability is made in accordance with articles 3, 4 and 5 of the SFDR (last updated in September 2025).

Integration of sustainability risk in the investment policies

A sustainability risk means “an environmental, social or governance event or condition that, if it occurs, could cause an actual or potential material negative impact on the value of the investment”. For the Funds, sustainability risks are risks which, if they were to become reality, would cause a material negative impact on the value of its portfolio companies (sustainability risk).

There will be no formal consideration of sustainability risks in the decision-making process regarding the Funds in accordance with article 3 of the SFDR and we do not plan to do so in the future. The GP will re-evaluate the possibility to consider sustainability risks in the decision-making process on an annual basis. In doing so, the GP can assess and evaluate the overall ESG performance of both Funds’ portfolio companies and provide guidance and support when needed, to the extent the respective Fund has the possibility to do so and the identified risk is material from both a financial and, or sustainability perspective.

In the pre-investment phase, an ESG risk and impact evaluation is part of the regular due diligence process. On the one hand, the GP performs a screening of possible short and long-term risks that may occur within the candidate portfolio companies. On the other hand, the GP also examines which themes the portfolio companies can generate positive impact on and establishes a link with SDG5 (gender equality), SDG8 (decent work and economic growth), SDG9 (industry, innovation and infrastructure), SDG12 (responsible consumption and production), SDG15 (life on land).The GP includes ESG information, where relevant or available, in the (i) initial screening of an investment opportunity, (ii) due diligence, during a three (3) week basecamp, in relation to a potential investment, and (iii) monitoring of the portfolio companies following an eighteen (18) month detailed milestone plan. This may include thematic sustainability information sourced from trustworthy sources and the use of an internal evaluation questionnaire to identify, analyze and document sustainability matters. This information is used when reviewing and approving an investment opportunity.

Principal adverse impact of investment decisions on sustainability factors

In accordance with article 4.1(b) of the SFDR, the GP states that it does not consider the adverse impacts of investment decisions on the sustainability factors as referred to in article 4.1(a) of the SFDR and does not make the disclosures as described in article 4.1(a) of the SDFR.

Given that the investment scope the Funds managed by the GP is primarily focused on start-ups in an early stage of their lifecycle, most of the portfolio companies of the Funds are not able to provide the necessary data that would allow the GP to report on what the adverse impacts of the investment decisions would be, based on the different criteria set forth in the SFDR and the legislation implementing the SFDR.

Although the GP integrates high-level ESG risk and impact screening and monitoring into the investment process, the GP is not able to communicate data and evolution reporting in accordance with the reporting requirements of the SFDR. At a later stage, the GP can re-evaluate, depending on the size of its own team and the ability of the portfolio companies to provide the necessary data for compliant reporting.

Integration of sustainability risk in the remuneration policy

The GP, as a sub-threshold manager of the Funds, does not have an obligation to have a formal remuneration policy in accordance with article 40 and following the Belgian law of April 19, 2014 on alternative entities for collective investments and their managers.

In practice, in accordance with general venture capital remuneration and award processes, a significant portion of an investment professional’s compensation is typically in deferred instruments aligned to the performance of investments, meaning that the value of an investment professional’s compensation will be negatively impacted by a sustainability risk that impacts the value of the underlying investment.

2 / BIOTOPE VENTURES – ARTICLE 8 SFDR DISCLOSURES

Summary

Biotope Ventures is a financial product that promotes environmental and/or social characteristics but does not have as its objective sustainable investment and does not invest in sustainable investments. No reference benchmark has been designated for the purpose of attaining the environmental and/or social characteristics promoted by Biotope Ventures.

Biotope Ventures is an early-stage venture capital fund which will target science-based start-ups developing solutions and commercialization opportunities in different thematic areas, starting with the agri-food industry and expanding to health/therapeutics industry and with potential for significant value creation in fast growing market segments in, inter alia, Belgium and the European Economic Area, having been selected to participate in Program (i.e. the biotope pre-seed incubator program, governed by VIB).

No sustainable investment objective

This financial product promotes environmental or social characteristics but does not have sustainable investments as its objective.

Environmental or social characteristics of the financial product

Biotope Ventures will aim at promoting the following, non-limited, list of environmental and social characteristics: SDG5 (gender equality), SDG8 (decent work and economic growth), SDG9 (industry, innovation and infrastructure), SDG12 (responsible consumption and production), SDG15 (life on land).

(Note: the related SDGs above are for indicative purposes only and may not perfectly overlap with one another, nor do they exclude positive impact on any of the other SDGs. )

It is, however, neither expected nor required that every portfolio company falls within the scope of any of the ESG priorities listed in the SFDR disclosures. Nonetheless, for the start-ups who can demonstrate a measurable (expected) impact on one or more of these priorities, this will be taken into consideration and positively affect their overall evaluation score in Biotope Ventures’ selection and self-reporting assessments.

Investment strategy

As mentioned earlier, Biotope Ventures is an early-stage venture capital fund which will target science-based start-ups developing solutions and commercialization opportunities in different thematic areas, starting with the agri-food and with potential for significant value creation in fast growing market segments in, inter alia, Belgium and the European Economic Area, having successfully completed Program.

Biotope Ventures does not directly or indirectly invest in, guarantee, or otherwise provide financial or other support to companies or other entities that engage in certain activities and/or sectors and are explicitly excluded in the product documentation.

Such exclusions, inter alia, relate to:

- Start-ups with products targeting industries such as:

- Gambling;

- Adult entertainment;

- Illegal substances/narcotics;

- Tobacco;

- Coal;

- Unconventional oil & gas; and

- Alcohol; and

- Weapons

Start-ups developing products to help prevent or counter any negative effects on health or the environment in these industries, could however be eligible.

- Start-ups with direct links to one of the “countries mentioned in the FATF list of ‘High-Risk Jurisdictions subject to a Call for Action’”, as per the Belgium FPS Finances website.

An analysis of the good governance practices of portfolio companies is also an integral part of the risk and impact screening for investments by Biotope Ventures. Good governance, including but not limited to sound management structures, healthy team dynamics, correct incentivation and diversity within the founding teams are key elements which are taken into account before making any investment. Biotope Ventures intends to break the gender gap in VC funding, which is why, for example, it does not invest in single founder teams and requires founders to have a majority on a shareholder level.

Pre-investment, an ESG risk and impact evaluation is part of the regular due diligence process. On the one hand, a screening of possible short and long-term risks that may occur within the candidate portfolio companies is performed. For this purpose, Biotope Ventures bases itself on the input provided by the companies during the three (3) week basecamp and uses its own experience and in-depth sector knowledge. Before making any investment, an analysis is made of the environmental, social and governance risks that these startups may be facing, with a main focus, given the stage of these companies, on the technology and product development. If the risks are considered too high, Biotope Ventures shall in principle refrain from investing. If the risks can be mitigated, a detailed milestone plan will be implemented for said portfolio company applicable up until eighteen (18) months following the investment by Biotope Ventures.

As Biotope Ventures will only invest in sustainable solutions in agriculture, food and materials, at its core, it will promote Environmental and/or Social characteristics. However, it will not make any sustainable investments, nor will it qualify as environmentally sustainable under the EU taxonomy.

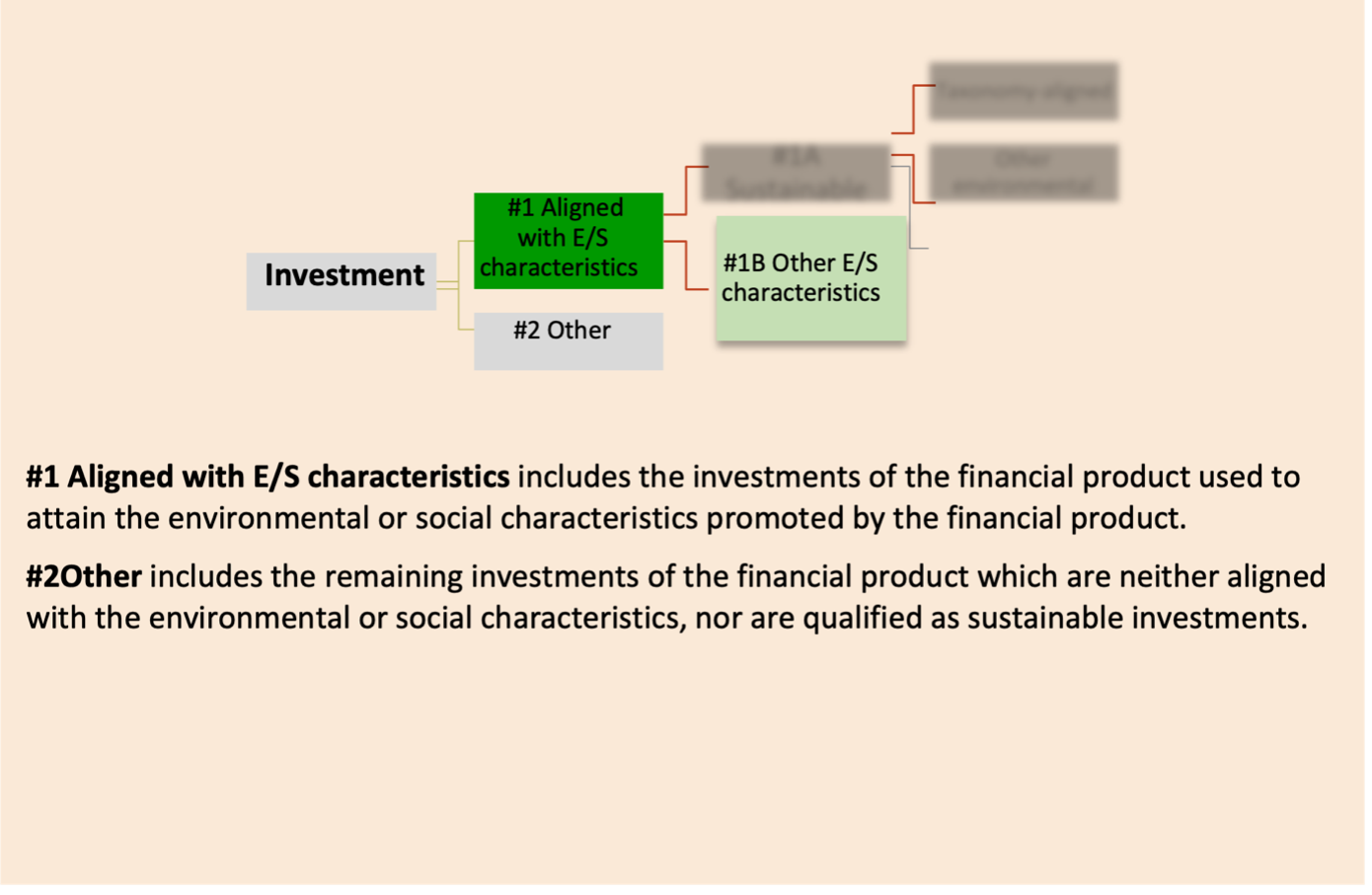

Proportion of investments

All investments of Biotope Ventures can be categorized as “#1 Aligned with E/S characteristics”. None of Biotope Ventures’ investments are included under “#2 Other”.

The investment strategy leads Biotope Ventures to invest in companies at a very early stage in development, often just consisting of a few team members and a technology prior to proof of concept. As a result, we consider the direct impact on environmental factors still relatively low for almost all our portfolio companies. We believe that their positive impact will be larger on the social and governmental characteristics, hence we expect the accurate proportion of our investments to evolve over time, as the additional SFDR related frameworks regarding social and governmental characteristics are rolled out.

Our ESG assessment is tailored to the needs of and requirements for early-stage companies. Our approach is detailed in two procedures: an ESG assessment (pre-investment) and an ESG monitoring and reporting (post-investment).

Monitoring of environmental or social characteristics

We believe that implementing ESG in Biotope Ventures’ decision-making process not only mitigates business risks, but also creates long-term value for businesses, resulting in better financial return for it. It is, however, neither expected nor required that every portfolio company falls within the scope of any of the ESG priorities as listed in the SFDR disclosures. Nonetheless, for the start-ups who can demonstrate a measurable (expected) impact on one or more of these priorities, this will be taken into consideration and positively affect their overall evaluation score in Biotope Ventures’ selection and self-reporting assessments.

Post-investment, the portfolio companies will be part of the Program which has a duration of eighteen (18) months. During this period a detailed milestone plan will be followed step-by-step with an evaluation in bi-weekly meetings, this includes ESG and impact. Directly after the investment decision the portfolio company receives a first payment of the investment amount under the convertible loan; payment of the subsequent two (2) (or more) tranches will depend on the progress made in the above-mentioned milestone based plan.

Biotope Ventures can draw on a broad experience and a large knowledge network to support portfolio companies in a variety of ESG topics where necessary. This support will be offered by the managers, or the portfolio companies can be referred to experts from the Biotope network.

Methodologies

Qualitative performance monitoring in the field of ESG themes is done on a regular basis through the contacts that Biotope Ventures’ portfolio managers maintain with the portfolio companies. When observations or incidents occur at the portfolio companies related to the topics as defined in the SFDR disclosures, these are followed up by the portfolio manager and, where necessary, escalated within the relevant governance structure.

Data sources and processing

To measure the ESG performance of Biotope Ventures, it retains the right of sourcing data on the portfolio companies’ products or services from the companies themselves through interviews.

Pre-investment, this ESG-related risk assessment and impact data gathering is an integral part of the due diligence on the prospective ventures of Biotope Ventures. Each time Biotope Ventures makes an investment, the portfolio company’s focus will be screened for any exclusion criteria and its ESG-related risk factors are detailed, according to the procedure described in the SFDR disclosures.

In the definitive transaction documentation, which includes a detailed eighteen (18) months milestone plan, Biotope Ventures will define the reporting requirements and add the extra agreed actions to be taken in to account.

Post-investment, the portfolio companies will be part of the biotope incubator program which has a duration of eighteen (18) months. During this period a detailed milestone plan will be followed step-by-step with an evaluation in bi-weekly meetings, this includes ESG and impact. Directly after the investment decision the portfolio company receives a first payment of the investment amount under the convertible loan; payment of the subsequent two (2) (or more) tranches will depend on the progress made in the above-mentioned milestone based plan.

This process gives the investment team a good insight into the practices, decisions and events of the portfolio companies related to environmental topic, social affairs, and governance themes. It’s an opportunity to monitor the impact and possible risks for growing companies.

Reporting on Biotope Ventures’ investments will be done in accordance with Annex IV to the Regulatory Technical Standards of the SFDR.

Limitations to methodologies and data

Data quality and reliability is largely anchored on the data gathered by the portfolio companies themselves, and the analyses of Biotope Ventures’ portfolio managers, that is largely based on a limited set of comparison data.

The companies that Biotope Ventures invests in, are not yet at scale level, so the impact on the environmental or social characteristics is not always representative.

Due diligence

During a three (3) week basecamp, Biotope Ventures assesses the company’s technology, team, commercial roadmap, financial and legal status, intellectual property strategy, as well as on ESG and impact aspects.

An ESG-related risk assessment and impact analysis is an integral part of this process.

Please refer to the Sections “Investment Strategy” and “Data Sources and Processing” above for a further description of Biotope Ventures’ due diligence.

Engagement policies

Following an investment and during the eighteen (18) month period during which the startup is part of the biotope incubator program, the portfolio managers monitor the portfolio companies’ ESG compliance, as well as their financial and non-financial performance, taking into account the stage of maturity of the portfolio company. It is, however, neither expected nor required that every portfolio company falls within the scope of any of the ESG priorities as listed in the SFDR disclosures.

The executive task of monitoring the ESG commitments is assigned to the portfolio manager of Biotope Ventures dedicated to the specific portfolio company.

In the definitive transaction documentation, which includes a detailed eighteen (18) months milestone plan, Biotope Ventures will define the reporting requirements and add the extra agreed actions to be taken in to account.

Index as reference

Not applicable since there is no reference benchmark designated for the purpose of attaining the environmental and/or social characteristics promoted by Biotope Ventures.

3 / BIOTOPE VENTURES II – ARTICLE 8 SFDR DISCLOSURES

Summary

Biotope Ventures II is a financial product that promotes environmental and/or social characteristics but does not have as its objective sustainable investment and does not invest in sustainable investments. No reference benchmark has been designated for the purpose of attaining the environmental and/or social characteristics promoted by Biotope Ventures II.

Biotope Ventures II is an early-stage venture capital fund which will target companies that have a special focus on technology and with potential for significant value creation in fast growing market segments in, inter alia, Belgium and the European Economic Area, having successfully completed The Biotope Basecamp and the Biotope Program. Biotope Ventures II will only invest in startups that are active in sustainable agriculture, food and materials (the so-called planetary health sector).

No sustainable investment objective

This financial product promotes environmental or social characteristics but does not have sustainable investments as its objective.

Environmental or social characteristics of the financial product

Biotope Ventures II will aim at promoting the following, non-limited, list of environmental and social characteristics: SDG5 (gender equality), SDG8 (decent work and economic growth), SDG9 (industry, innovation and infrastructure), SDG12 (responsible consumption and production), SDG15 (life on land).

(Note: the related SDGs above are for indicative purposes only and may not perfectly overlap with one another, nor do they exclude positive impact on any of the other SDGs. )

It is, however, neither expected nor required that every portfolio company falls within the scope of any of the ESG priorities listed in the SFDR disclosures. Nonetheless, for the start-ups who can demonstrate a measurable (expected) impact on one or more of these priorities, this will be taken into consideration and positively affect their overall evaluation score in Biotope Ventures II’s selection and self-reporting assessments.

Investment strategy

As mentioned earlier, Biotope Ventures II is an early-stage venture capital fund which will target companies that have a special focus on technology and with potential for significant value creation in fast growing market segments in, inter alia, Belgium and the European Economic Area, having successfully completed The Biotope Basecamp and the Biotope Program. It will only invest in startups that are active in sustainable agriculture, food and materials (the so-called planetary health sector).

Biotope Ventures II does not directly or indirectly invest in, guarantee, or otherwise provide financial or other support to companies or other entities that engage in certain activities and/or sectors and are explicitly excluded in the product documentation.

Such exclusions, inter alia, relate to:

- Consultancy firms, agencies, engineering bureaus or third-party software development houses (e., in general project-based businesses or service companies).

- Start-ups with products targeting industries such as:

- Gambling;

- Adult entertainment;

- Illegal substances/narcotics;

- Tobacco;

- Coal;

- Unconventional oil & gas; and

- Alcohol; and

- Weapons

Start-ups developing products to help prevent or counter any negative effects on health or the environment in these industries, could however be eligible.

- Companies violating any of the minimum protection standards to comply with social and governance protection mechanisms from the UN guiding principles on business & Human Rights and OECD guidelines.

- Start-ups developing copies of existing products, i.e., me-too products without an innovative component. The innovative aspect can however be in the technology component and/or the business model.

- Start-ups with direct links to one of the “countries mentioned in the FATF list of ‘High-Risk Jurisdictions subject to a Call for Action’”, as per the Belgium FPS Finances website.

An analysis of the good governance practices of portfolio companies is also an integral part of the risk and impact screening for investments by Biotope Ventures II. Good governance, including but not limited to sound management structures, healthy team dynamics, correct incentivation and diversity within the founding teams are key elements which are taken into account before making any investment. Biotope Ventures II intends to break the gender gap in VC funding, which is why, for example, it does not invest in single founder teams and requires founders to have a majority on a shareholder level.

Pre-investment, an ESG risk and impact evaluation is part of the regular due diligence process. On the one hand, a screening of possible short and long-term risks that may occur within the candidate portfolio companies is performed. For this purpose, Biotope Ventures II bases itself on the input provided by the companies during the three (3) week basecamp and uses its own experience and in-depth sector knowledge. Before making any investment, an analysis is made of the environmental, social and governance risks that these startups may be facing, with a main focus, given the stage of these companies, on the technology and product development. If the risks are considered too high, Biotope Ventures II shall in principle refrain from investing. If the risks can be mitigated, a detailed milestone plan will be implemented for said portfolio company applicable up until eighteen (18) months following the investment by Biotope Ventures II.

As Biotope Ventures II will only invest in sustainable solutions in agriculture, food and materials, at its core, it will promote Environmental and/or Social characteristics. However, it will not make any sustainable investments, nor will it qualify as environmentally sustainable under the EU taxonomy.

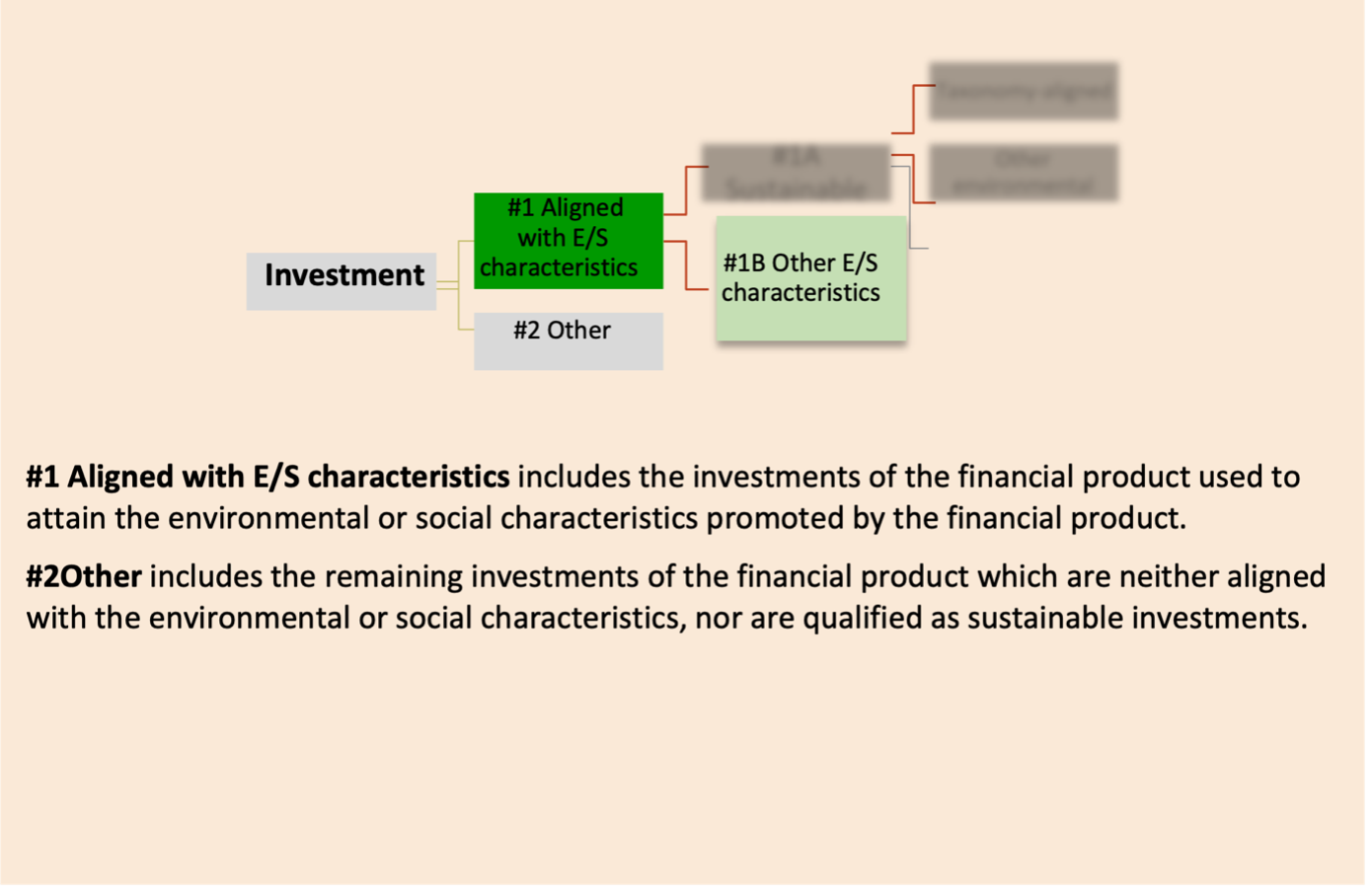

Proportion of investments

All investments of Biotope Ventures II can be categorized as “#1 Aligned with E/S characteristics”. None of tit’s investments are included under “#2 Other”.

The investment strategy leads Biotope Ventures II to invest in companies at a very early stage in development, often just consisting of a few team members and a technology prior to proof of concept. As a result, we consider the direct impact on environmental factors still relatively low for almost all our portfolio companies. We believe that their positive impact will be larger on the social and governmental characteristics, hence we expect the accurate proportion of our investments to evolve over time, as the additional SFDR related frameworks regarding social and governmental characteristics are rolled out.

Our ESG assessment is tailored to the needs of and requirements for early-stage companies. Our approach is detailed in two procedures: an ESG assessment (pre-investment) and an ESG monitoring and reporting (post-investment).

Monitoring of environmental or social characteristics

We believe that implementing ESG in Biotope Ventures II’s decision-making process not only mitigates business risks, but also creates long-term value for businesses, resulting in better financial return for Biotope Ventures II. It is, however, neither expected nor required that every portfolio company falls within the scope of any of the ESG priorities as listed in the SFDR disclosures. Nonetheless, for the start-ups who can demonstrate a measurable (expected) impact on one or more of these priorities, this will be taken into consideration and positively affect their overall evaluation score in Biotope Ventures II’s selection and self-reporting assessments.

Post-investment, the portfolio companies will be part of the biotope incubator program which has a duration of eighteen (18) months. During this period a detailed milestone plan will be followed step-by-step with an evaluation in bi-weekly meetings, this includes ESG and impact. Directly after the investment decision the portfolio company receives a first payment of the investment amount under the convertible loan; payment of the subsequent two (2) (or more) tranches will depend on the progress made in the above-mentioned milestone based plan.

Biotope Ventures II can draw on a broad experience and a large knowledge network to support portfolio companies in a variety of ESG topics where necessary. This support will be offered by the managers, or the portfolio companies can be referred to experts from the Biotope network.

Methodologies

Qualitative performance monitoring in the field of ESG themes is done on a regular basis through the contacts that Biotope Ventures II’s portfolio managers maintain with the portfolio companies. When observations or incidents occur at the portfolio companies related to the topics as defined in the SFDR disclosures, these are followed up by the portfolio manager and, where necessary, escalated within the relevant governance structure.

Data sources and processing

To measure the ESG performance of Biotope Ventures II, it retains the right of sourcing data on the portfolio companies’ products or services from the companies themselves through interviews.

Pre-investment, this ESG-related risk assessment and impact data gathering is an integral part of the due diligence on the prospective ventures of Biotope Ventures II. Each time Biotope Ventures II makes an investment, the portfolio company’s focus will be screened for any exclusion criteria and its ESG-related risk factors are detailed, according to the procedure described in the SFDR disclosures.

In the definitive transaction documentation, which includes a detailed eighteen (18) months milestone plan, Biotope Ventures II will define the reporting requirements and add the extra agreed actions to be taken in to account.

Post-investment, the portfolio companies will be part of the biotope incubator program which has a duration of eighteen (18) months. During this period a detailed milestone plan will be followed step-by-step with an evaluation in bi-weekly meetings, this includes ESG and impact. Directly after the investment decision the portfolio company receives a first payment of the investment amount under the convertible loan; payment of the subsequent two (2) (or more) tranches will depend on the progress made in the above-mentioned milestone based plan.

This process gives the investment team a good insight into the practices, decisions and events of the portfolio companies related to environmental topic, social affairs, and governance themes. It’s an opportunity to monitor the impact and possible risks for growing companies.

Reporting on Biotope Ventures II’s investments will be done in accordance with Annex IV to the Regulatory Technical Standards of the SFDR.

Limitations to methodologies and data

Data quality and reliability is largely anchored on the data gathered by the portfolio companies themselves, and the analyses of Biotope Ventures II’s portfolio managers, that is largely based on a limited set of comparison data.

However, Biotope Venture II’s investment horizon is at a very early stage and the relevance of the data is relative. The companies that it invests in, are not yet at scale level, so the impact on the environmental or social characteristics is not always representative.

Due diligence

During a three (3) week basecamp, Biotope Ventures II assesses the company’s technology, team, commercial roadmap, financial and legal status, intellectual property strategy, as well as on ESG and impact aspects.

An ESG-related risk assessment and impact analysis is an integral part of this process.

Please refer to the Sections “Investment Strategy” and “Data Sources and Processing” above for a further description of Biotope Ventures II’s due diligence.

Engagement policies

Following an investment and during the eighteen (18) month period during which the startup is part of the biotope incubator program, the portfolio managers monitor the portfolio companies’ ESG compliance, as well as their financial and non-financial performance, taking into account the stage of maturity of the portfolio company. It is, however, neither expected nor required that every portfolio company falls within the scope of any of the ESG priorities as listed in the SFDR disclosures.

The executive task of monitoring the ESG commitments is assigned to the portfolio manager of Biotope Ventures II dedicated to the specific portfolio company.

In the definitive transaction documentation, which includes a detailed eighteen (18) months milestone plan, Biotope Ventures II will define the reporting requirements and add the extra agreed actions to be taken in to account.

Index as reference

Not applicable since there is no reference benchmark designated for the purpose of attaining the environmental and/or social characteristics promoted by Biotope Ventures II.